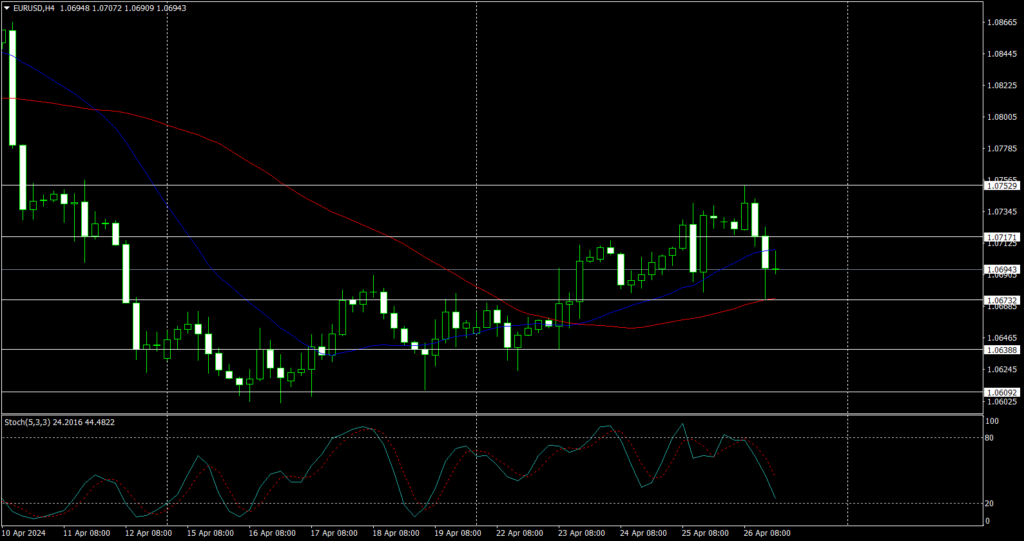

The past week saw Euro following through on a double bottom breakout though not quite hitting the pattern’s target. This has largely been on the back of weakness in US economic data that revived hopes for an easing sooner rather than later along with some flashes of strength from the Eurozone services sector. Ahead we get a preview of the regions inflation story with Preliminary CPI from Germany forecast to read 0.6% month-on-month.

Resistance

- 1.08019- 50D Moving Average

- 1.07529 – Friday High

- 1.07182 – Intraday Consolidation Floor

Support

- 1.06732 – Friday’s Low

- 1.06388 – Intraday Consolidation Floor

- 1.06012 – Swing Low 4/16

EURUSD has come off the 38.2 Fib retracement level of its downswing from March 2024. Though not a classic bearish reversal pattern the sell-off Friday has enough body to see the daily oscillator come-off overbought levels with a bearish crossover giving us a bias for the sell-side. That said we are in no hurry to jump short preferring to look for long wicks from off the 1.07182 and 1.07529 area. Failure to see a solid push under Friday’s lows will have us looking for base building and the possibility of a consolidation around Friday’s range in the coming days.