The Japanese Yen was late to the party in responding to the FOMC meeting that market interpreted as Dovish. What was actually said by Fed Chairman Jerome Powell was that rates will be steady due to persistent inflationary pressures though some have been hoping that any rate cuts this year will be clearly ruled out. A more extreme segment of the market actually calling for one more rate increase thus the disappointment.

Resistance

- 159.60/160.19 – Intraday High / Multi Decade High

- 157.986 – Wednesday High

- 156.490 – Intraday Low

Support

- 154.504/558 – Monday Low / 20D Moving Average

- 153.016 – Wednesday Low

- 151.92/152.01 – 50D Moving Average / Previous Daily Range Play Resistance

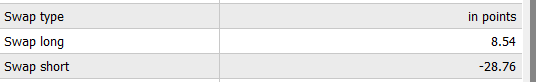

At this point we will simply reiterate that USDJPY is a buy on dips not because of the chart but for fundamental reasons. Decades of zero rate policy has failed to actually reflate the economy and if the Japanese government wants to see economic and wage growth the only other way is to allow for a weaker currency to boost competitiveness and force companies to give substantial raises and encourage domestic spending. Note BoJ Governor has already said that direct intervention in fx is not a policy so anytime supply / demand imbalances causes a drop it an opportunity to buy the pair at lower prices and gain from swap and price changes.