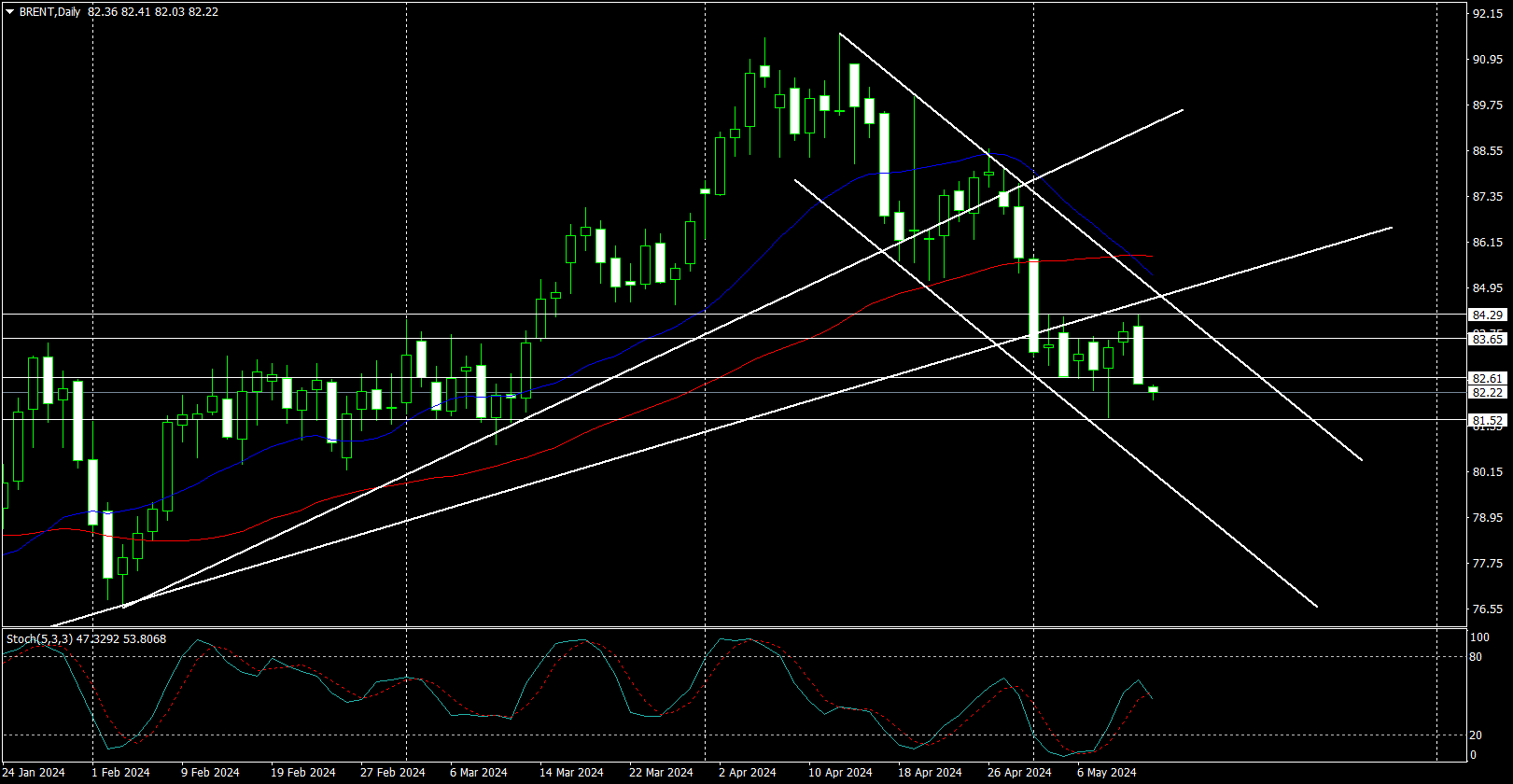

Oil prices continue to ignore the Middle East conflict and will likely continue to as long as it remains localized in Gaza, and against Hezbollah in Southern Lebanon. For now the primary concern for the market is demand and a narrative of delays in US easing is keeping prices vulnerable along with economic weakness in China that has already translated to less purchases of middle east oil of late.

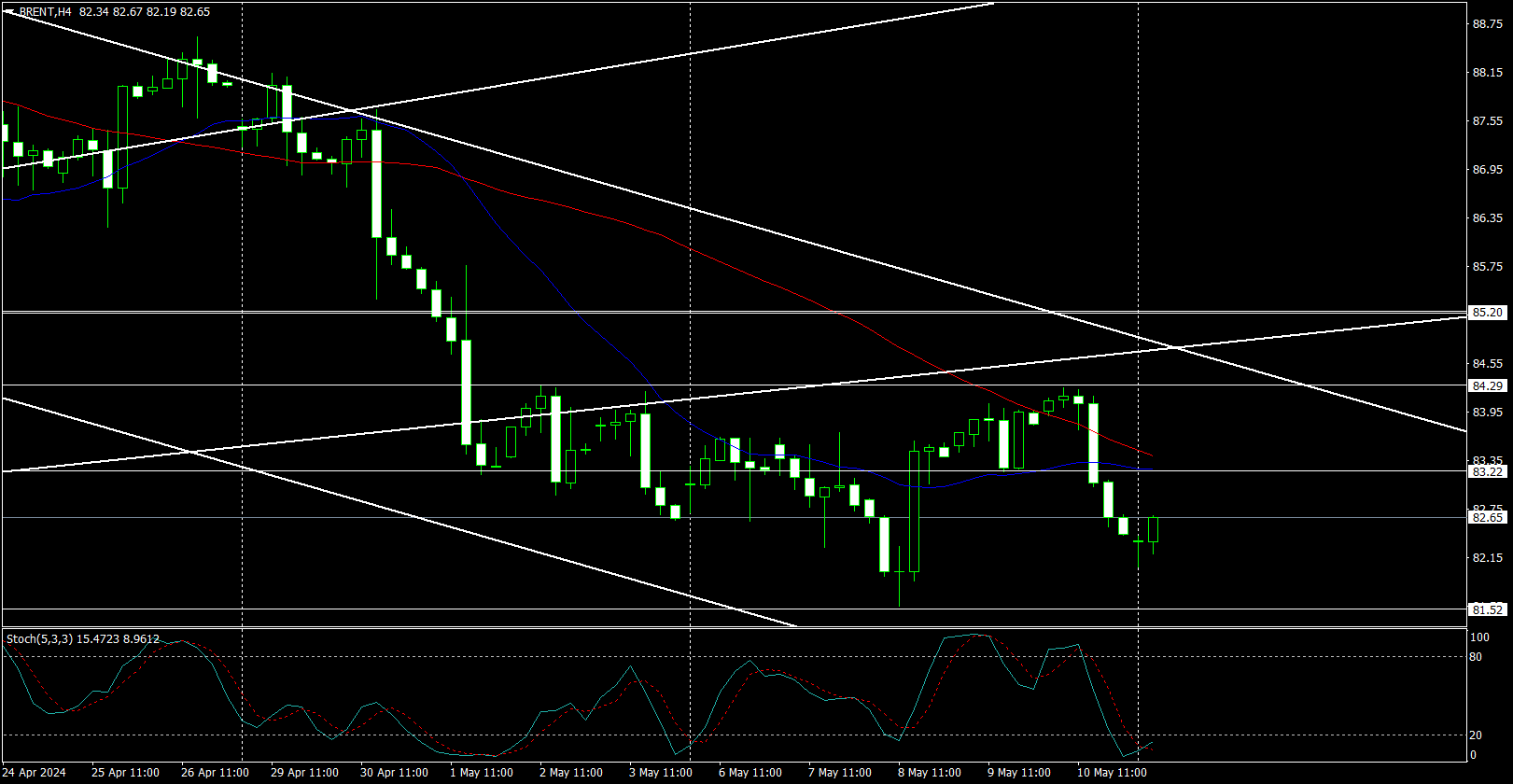

Resistance

- 85.28 – 20D Moving Average

- 84.29 – Daily Consolidation High

- 83.22 – Intraday Lows

Support

- 82.03 – Intraday Dragon Fly Doji Low

- 81.55 – Daily Consolidation Low

- 80.85 – Daily Consolidation Low

Given the close from Friday and over the weekend reports, bias for oil is for the sell side with even the stochastic showing a new bearish crossover. This said we also have a strong support at the 81.55 region, last weeks low and the consolidation floor from February/March we favor a buy on dips approach looking for the consolidation to continue. Any approach of 84.29 can also be seen as a bearish entry with long hourly wicks.