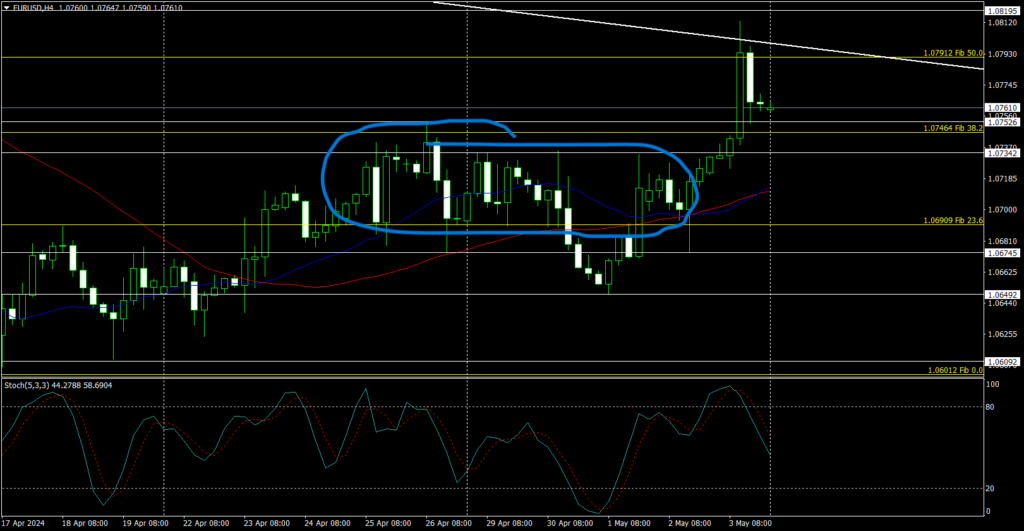

EURUSD’s knee-jerk response to the poor showing in US Jobs data proved unsustainable with a rejection from the bearish trend line. Although US NFP fell-short of consensus at 175,000 and the Unemployment Rate inched up to 3.9% these are not drastic enough results to change the Fed’s thinking and convince it to cut rates in June. At this point we shall think of EURUSD as being in equilibrium in need of more positive news from the Eurozone for a clear break of the bearish trend line.

Resistance

- 1.08466 – Intraday Consolidation Resistance/Floor

- 1.08210 – Intraday Consolidation Floor

- 1.07929/000 – 50D Moving Average / Bearish Trend line

Support

- 1.07529 – Previous Range Play High

- 1.07006 – 20D Moving Average

- 1.06494 – Previous Range Play Floor

With the long wick Friday, EURUSD’s upside appears capped by the daily trend line with the 4H Charts even showing us a Dark Cloud Cover bearish reversal. With little data of note for the day our bias will be to look for weakness either a rejection once more from the trend line, sell on rallies. Or a drop under 1.07529 taking EURUSD back into the previous range play. It would take a daily close above the trend line to convince us there is scope for further upside.