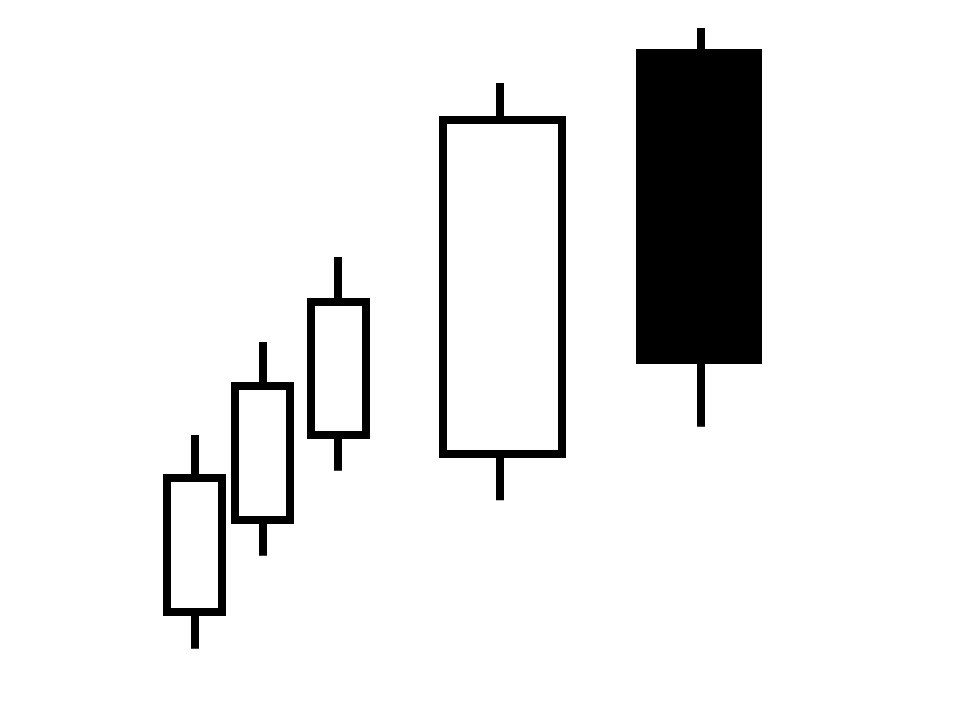

The ‘Dark Cloud Cover’ is a two-candlestick bearish reversal pattern consisting of a white candle with a big body and a black candlestick that opens above the high of the initial candle. After opening at the highs the second candlestick should push well inside the body of the first candle and close near the lows for the period. The name derives from how dark clouds can dampen sentiment. This is considered to be a high credibility pattern.

Technical Description

1) The first white candlestick should have a big body and be preceded by a bullish market.

2) We see the next candlestick open above the high of the first and push back inside.

3) The second candle should close below the middle of the preceding white candlesticks’ body, preferably near its lows.

Mark’s Perspective

Dark Cloud Cover’s often occur at the top of a ranging market though they also turn up in bullish trending markets. The fact that the second candle opened above the high of the first suggests sentiment is very bullish but the failure to follow through and the subsequent close well into the body of the first candle suggests bears have managed to wrest control of the market.

In case of a ranging market immediate shorts may be taken provided there is sufficient room to maneuver, i.e. the range floor is substantially lower. When in a clear uptrend a gap down can be used to confirm a bear market, or a lower close and a black candle. No matter the situation stop losses should be placed above the second candlestick’s highs. The deeper the penetration of the second candlestick the more significant the pattern becomes.